|

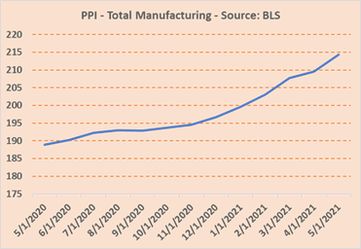

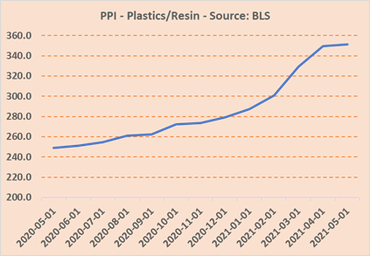

With significant pressures building, PE firms and Their Portfolio Companies Need to Act Proactively As Recent Supply Chain Distruptions are Creating Inflation  “Good luck finding a rental car in Hawaii! My friend ended up renting a U-Haul on her Hawaiian vacation recently because she couldn’t get a rental car due to the shortage.” These are words we never expected to hear this summer, but have. A series of unrelated recent events – the Covid-19 pandemic, expiration of temporary tariffs relief, the deep freeze in Texas, the Suez Canal blockage, and the Colonial Pipeline hacking incident - have led to a severely disrupted global supply chain – and in turn, supply chain disruptions like these. A significant imbalance between supply and demanding is also fueling inflation. As demand rebounds as pandemic restrictions are lifted, and the American economy feels the effects of the $1.9 trillion stimulus package, supply is constrained due to raw materials shortages and shipping delays. With supply not meeting demand, Producer Price Index (PPI) as measured by different Bureau of Labor Statistics (BLS) indices is significantly higher than twelve months ago. Input cost increases are resulting in both business to business and business to consumer price increases. For instance, US gasoline prices are at a 7 year high, used car prices are up 24% year-over-year, and lumber prices are up a whopping 95% from pandemic lows.  Portfolio Company Impact Many PE portfolio companies whose revenues were negatively impacted by Covid have seen a healthy bounce back, with business back at close to pre-Covid levels. However, while some of these companies used Covid as an opportunity for some belt tightening, none of them forecasted the level of inflation we are seeing in input pricing. As the rest of 2021 unfolds, this will lead to significant margin erosion, which most companies have not anticipated for, or built into their budgets and financials. Many portfolio companies, as they close out the year, will be looking at significantly worse financials (than current forecasts) if they do not act proactively. How Can Private Equity Firms & Their Portfolio Companies Combat Inflation 1. "Push Back" Against Supplier Cost Increases

2. Pass through Price Increases to Customers (where possible)

3. Utilize Strategic Sourcing

About Treya Partners Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and COGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com. By: Barnali Mishra About the Author Barnali Mishra is a Principal with Treya Partners. Barnali has over 17 years of procurement consulting experience and has delivered high impact procurement and supply chain services to numerous private equity firms and their portfolio companies. Barnali has led and managed strategic sourcing initiatives addressing over forty spend categories and has extensive experience performing spend analysis, opportunity assessments, planning and executing competitive solicitations, conducting complex category strategic sourcing, and performing fact-based supplier negotiations. Barnali holds both a BA and an MA from Stanford University. Barnali resides in San Francisco and enjoys traveling the world with her husband and daughter.

1 Comment

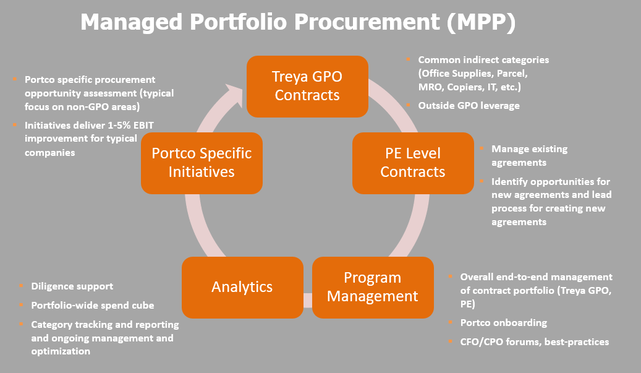

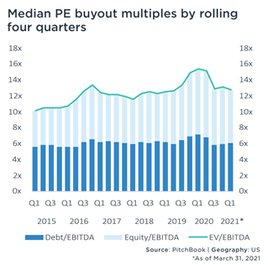

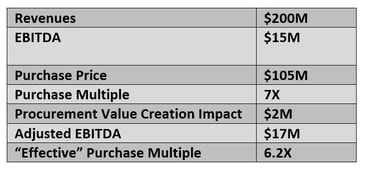

A Key Missing Ingredient in the Private Equity Due Diligence Process in Today's Market  The Backdrop: It's a Sellers Market with Dry Powder at a High Within the world of private equity, dry powder has reached a new high of $1.4 trillion, having grown 17% annually since 2015. In turn, there are a lot of investors and not enough deals to be found. It is a seller’s market, and GPs are having a tough time justifying doing deals at today’s high multiples of 12 – 17x. Concurrently, in our experience at Treya Partners, we find very few Private Equity (PE) firms formally incorporate procurement value creation into their due diligence and underwriting process. Sometimes contract risk mitigation (e.g., in the case of Carve Outs) is considered, but rarely are procurement cost savings reliably estimated and underwritten into the deal thesis. With purchase multiples being high and a fiercely competitive market for deals, GPs need to recognize the competitive edge that can be gained from reliably estimating and underwriting procurement value creation into the deal.  Why to Incorporate Procurement into the Due Diligence Process We at Treya recommend that PE firms begin including Procurement Value Creation as a critical element of their due diligence strategy. Not only can procurement optimization improve cash flow right away, it can set the stage for future acquisitions, and ultimately, maximize value at exit. More importantly, if there is a significant procurement opportunity, it can lead to a much lower “effective” purchase multiple for the deal, allowing for a higher purchase price and ultimately in a higher close rate. How & When to Incorporate Procurement into Due Diligence Incorporating procurement value into your firm’s due diligence is not difficult – an Accounts Payable (AP) spend analysis will give you a directional idea of the procurement savings opportunity available. Include procurement up front in your data collection efforts - request a year’s worth of AP data and know that high-level spend by vendor data will suffice if that is all that is readily available. Potential procurement savings and associated value can then be estimated from this data. In addition to SG&A expenses, COGS can also be targeted to significantly enhance the opportunity. A confidence level should be built into savings estimates to mitigate execution risk. Done right, this process will create a significant competitive edge for winning deals. Sources: Pitchbook, Private Equity Wire By: Barnali Mishra Mishra is a Principal with Treya Partners. Barnali has over 17 years of procurement consulting experience and has delivered high impact procurement and supply chain services to numerous private equity firms and their portfolio companies. Barnali has led and managed strategic sourcing initiatives addressing over forty spend categories and has extensive experience performing spend analysis, opportunity assessments, planning and executing competitive solicitations, conducting complex category strategic sourcing, and performing fact-based supplier negotiations. Barnali holds both a BA and an MA from Stanford University. Barnali resides in San Francisco and enjoys traveling the world with her husband and daughter. The 5 Most Important Considerations in Launching a Successful Private Equity Procurement Program4/19/2021  At Treya Partners, our focus is primarily on cost reduction initiatives for Mid-Market Private Equity firms and their portfolio companies. As you would expect, we have conversations with mid-market firms on a daily basis regarding value creation. These conversations provide us with unique insights across a wide range of Private Equity firms regarding how Value Creation is addressed today. When we ask about value creation, there is one common theme that we keep hearing: procurement has historically been a blind spot at the PE level. There are multiple challenges that have contributed to procurement being under leveraged as a value creation lever for mid-market firms. Those include a lack of resources, changing priorities, perceived value, shifting responsibilities for team members, and turnover at firms. To combat these challenges, we’ve developed our Managed Portfolio Procurement (MPP) program, which addresses 5 key considerations and provides portfolio companies with a world class procurement offering. Here is a breakdown of those 5 focus areas: 1. Is there clear visiblity into the portolio's spend base? The ability to execute on cost reduction opportunities within a portfolio is only possible if there is clear visibility into the spend base for each portfolio company. It is critical that Accounts Payable (AP) data is collected and categorized on an annual basis for each company within a PE portfolio. Simple AP data analytics will go a long way in understanding where the strategic procurement opportunities exist both at the portfolio and cross-portfolio levels. Building out and maintaining a cross-portfolio spend cube is step one in realizing meaningful procurement value creation outcomes. 2. Is the strategy for low hanging fruit too simple? Interestingly, one of the biggest inhibitors of PE firms that keep them from being able to properly address procurement has been the prevalence of Group Purchasing Organizations (GPOs) in Private Equity. Don’t get us wrong, GPOs for common indirect spend categories such as small parcel, office supplies, and car rental are vital to a holistic procurement program and are part of our toolkit. However, it is all too common for PE firms to roll out GPO contracts to their portfolio companies, consider procurement to be “addressed,” and move on to the next priority, leaving millions of dollars on the table for their portfolio companies. GPOs work for portfolio companies with small to medium size spend in select categories, but once spend in a category exceeds a certain spend level, “off-the-shelf” GPO pricing is rarely the most competitive. 3. Does a strategy exist for portfolio company specific engagements to garner a higher return? The most meaningful procurement impact and EBIT relief will come from strategic portfolio company specific procurement optimization projects. These engagements will use the AP data analytics mentioned above to identify multiple spend categories at a portfolio company that can be addressed through strategic sourcing. Some common reasons why significant strategic procurement opportunities exist at mid-market PE backed companies are a lack of in-house category expertise, fragmented purchasing, a lack of unit level data, and a lack of procurement resources. The ability to identify and execute on these cost reduction opportunities at the portfolio company level in a rapid fashion (3-6 months) creates excitement amongst both the executive teams at portcos and PEdeal teams. 4. Does the program enable and develop procurement leaders across the portfolio? Introducing procurement knowledge and expertise to specific portfolio company is certainly useful, but being able to effectively share and transfer knowledge across the portfolio and educate multiple companies on procurement best practices is an additional layer of value that a best-in-class PE procurement program can provide. Providing the portfolio with access to CFO forums, procurement panel discussions, and SME presentations will help to maximize the utilization of procurement best practices. 5. Can spend be leveraged across the portfolio in certain categories? When reviewing a portfolio wide spend cube comprised of AP spend data from each portfolio company, common vendors and spend categories should emerge. This will be even more apparent if the PE firm’s investment focus is sector driven. There are a number of spend categories where there is a significant opportunity to leverage spend cross portfolio and use the portfolio’s collective purchasing power to negotiate favorable discount and rebate structures with best-in-class vendors. Treya’s MPP program is a holistic five-pronged program that creates a strong procurement foundation for our private equity clients by addressing each of the above areas. Our approach was developed through years of experience working alongside mid-market PE deal and ops teams and implements a program that can rapidly create meaningful EBIT impact while withstanding the headwinds of a fluid and constantly changing PE environment. By Chris TasiopoulosChris Tasiopoulos is a Business Development Manager with Treya Partners. Based in Boston, MA, Chris supports Treya Partner's private equity clients in several key markets.

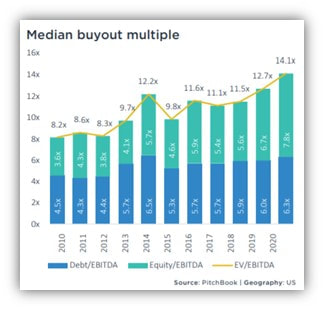

The coronavirus pandemic has not slowed private equity firms from putting their capital to work. Deal activity may have been down from March to April 2020, but deal volume was able to rebound by the fourth quarter of 2020, with deal counts and deal values reaching 10-year quarter highs. Deal multiples have also recovered from early 2020, with the median buy out multiple now at 14.1 (see chart 1). Historically, large, economically disruptive events like the "Great Recession" (2008 – 2010) have had a noticeable impact on private equity portfolio companies' holding periods. Specifically, investments made just before the recession, at peak valuations, were held longer. Chart 2 illustrates the increase in holding periods, peaking at 5.6 years in 2014. These acquisitions required longer holding periods to realize respectable returns. Consequently, median holding periods elongated. From 2014 – 2018, median holding periods for PE portfolio company exits showed a slight-but-steady downward trend, then leveled off just below five years. The coronavirus' extreme economic impact is expected to increase the median holding period as private equity firms delay exits, just like they did in the last recession.  Almost without exception, PE firms will be looking to carefully manage their portfolios and create value during these extended hold periods in the wake of the pandemic (Jones, 2020). Procurement represents an often-untapped opportunity for value creation for many PE firms and their portfolio companies. Many PE firms are behind the curve on managing procurement. Given that operational value creation can account for up to 50% of some funds' internal rates of return (IRR), procurement should be a strategic consideration at the fund level. Optimizing procurement can help PE firms and their operating companies reap the rewards and reduce portfolio risk. Treya Partners helps our private equity clients leverage advanced procurement capabilities portfolio-wide; this represents a competitive differentiator. Whether your objectives are EBITDA improvements, budgetary cost savings, organizational or business process improvements, or procurement capability development, we provide the right mix of services, best practices, and expertise to deliver results. Our procurement programs are a significant value creation lever for our clients in what remains a highly volatile climate. By Steven DelCarlino, Manager, Treya Partners About the Author Steven DelCarlino leads client engagements and project teams for Treya Partner’s private equity clients and their portfolio companies. With over 15 years of experience working directly with corporations, international businesses, and private equity portfolio companies on strategic sourcing projects, Steven brings a diverse knowledge of spend categories and project management experience. Steven and his team provide a rigorous fact-driven analysis that accounts for the total cost of ownership, service needs, and long-standing supplier relationships for each engagement. Steven has managed sourcing projects in the logistics, packaging, raw materials, finished goods, facilities services, MRO, IT, and wireless sectors, among others. Before joining Treya Partners, Steven was a Manager with GEP Worldwide, a global provider of strategy, software, and managed services to procurement and supply chain organizations. Steven also led the procurement and supply chain offering at CMF Associates (now CBIZ Private Equity Advisory), a financial and operational solutions provider to private equity firms and their portfolio companies. Steven holds a Bachelor of Business Administration from Temple University and is an MBA candidate at the Kettering University School of Management; Steven also has a Supply Chain Management Certification from Villanova University. References: Jones, A. (2020, May 07). Private equity portfolio company holding Periods – Updated. Retrieved February 25, 2021, from https://blog.privateequityinfo.com/index.php/2020/05/07/private-equity-portfolio-company-holding-periods-updated-4/ US PE Breakdown. (2021, January 11). Retrieved February 25, 2021, from https://files.pitchbook.com/website/files/pdf/2020_Annual_US_PE_Breakdown.pdf |

Categories

All

|