Private Equity Procurement Value Creation

Our services deliver high-impact procurement value creation through both cross-portfolio and portfolio company-specific procurement programs.

An Approach Applicable to Diverse Sectors |

|

Benefit from our comprehensive and nuanced approach regardless of your portfolio composition. Our approach has created meaningful value for PE portfolios in numerous areas including growth-focused technology, healthcare, manufacturing and distribution.

|

|

Leverage GPO Agreements

Piggyback on our multi-PE leveraged spend agreements for numerous indirect and direct spend categories. Drive substantial cost reductions quickly, in a risk-free manner, with minimal time and resource investment from portfolio companies. Pre-Exit All steps of the Private Equity (PE) investment process are critical from early-stage due diligence to the final exit. After years of executing on the investment thesis including process improvements, product pricing optimization, cost reduction, talent management, add-on’s, tuck-in’s and excercising other value creation levers, a poorly planned or executed exit can make the difference between a great deal and a good deal |

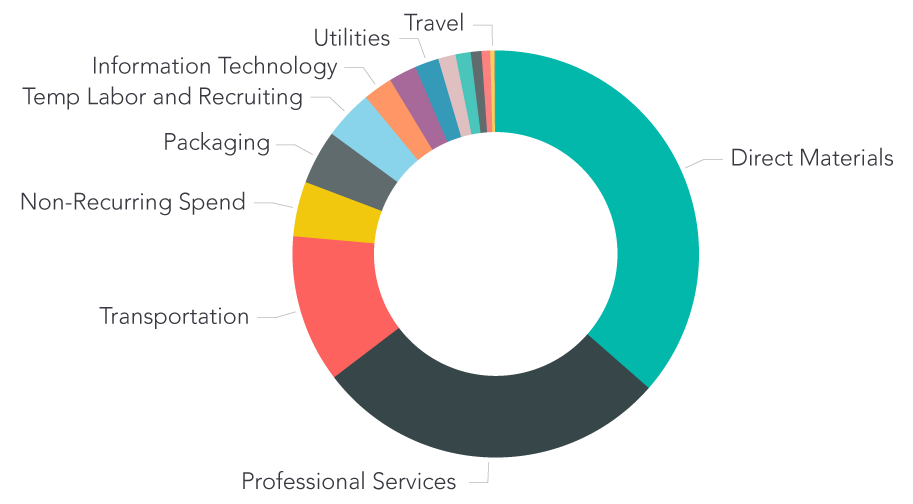

Portfolio Company-Specific Optimization

Use our portfolio company-specific “quick strike” approach to generate 3-10% EBIT improvements via a data-driven, highly analytical procurement process. Risk-free. Environmental, Social and Governance (ESG)

Multiple forces are driving the importance of ESG with significant pressure for private equity firms to adopt higher standards and reporting. Public opinion of private equity as corporate investors with sole interest on increasing value regardless of the collateral damage to the pressure on private equity from the LP’s to provide robust, cross-portfolio ESG reporting throughout the investment period is resulting in scrutiny on ESG performance. |

Managed Portfolio Procurement Program

Free up your operations teams to focus on working with portfolio companies on strategic initiatives and let us take on the burden of managing your procurement programs utilizing a combination of world-class contracts, our multi-category procurement expertise, and a cross-portfolio analytics platform Due Diligence Procurement Value Creation is a critical element of due diligence strategy. Not only can procurement optimization improve cash flow right away, it will set the stage for future acquisitions, and ultimately, maximize value at exit. More importantly, if there is a significant procurement opportunity, it can lead to a much lower “effective” purchase multiple for the deal, allowing for a higher purchase price and ultimately in a higher close rate. |

Private Equity Clients

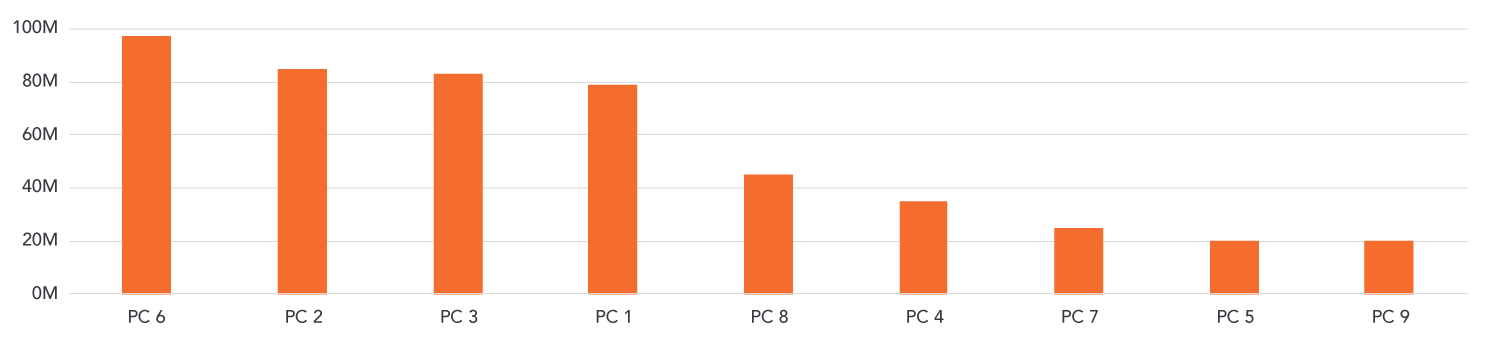

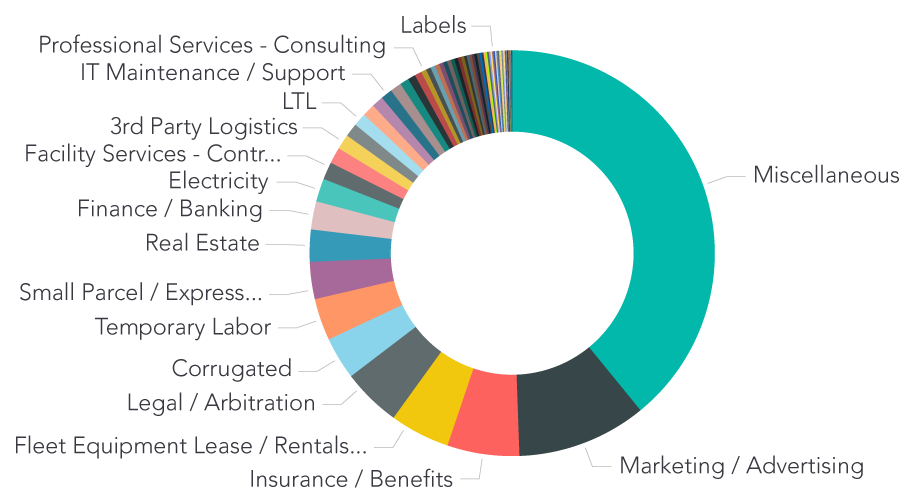

Cross-Portfolio Spend Visibility

Leverage our rules-based, self-learning process to access highly accurate data-mining of portfolio company financial data, gain comprehensive spend visibility, and identify high opportunity spend areas. Analysis can also be performed at the portfolio company level to support portfolio company specific initiatives.

"As a nimble and results-oriented partner, Treya has created exceptional value for our portfolio companies. They are one of the select few partners that we work with to create value in our portfolio. The ROI from their work has been very compelling and we continue to be pleased with their ongoing work in our portfolio."

- Senior Operations Executive, Top 5 PE Firm

- Senior Operations Executive, Top 5 PE Firm