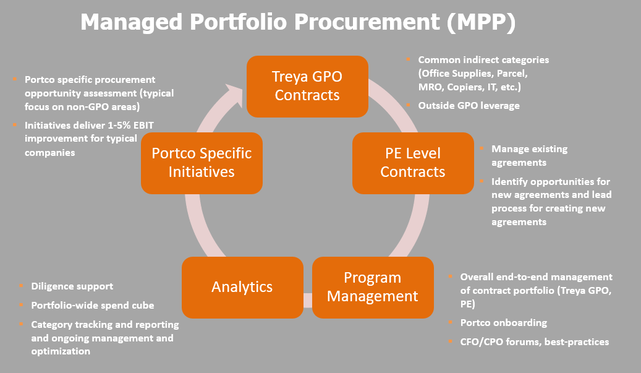

The 5 Most Important Considerations in Launching a Successful Private Equity Procurement Program4/19/2021  At Treya Partners, our focus is primarily on cost reduction initiatives for Mid-Market Private Equity firms and their portfolio companies. As you would expect, we have conversations with mid-market firms on a daily basis regarding value creation. These conversations provide us with unique insights across a wide range of Private Equity firms regarding how Value Creation is addressed today. When we ask about value creation, there is one common theme that we keep hearing: procurement has historically been a blind spot at the PE level. There are multiple challenges that have contributed to procurement being under leveraged as a value creation lever for mid-market firms. Those include a lack of resources, changing priorities, perceived value, shifting responsibilities for team members, and turnover at firms. To combat these challenges, we’ve developed our Managed Portfolio Procurement (MPP) program, which addresses 5 key considerations and provides portfolio companies with a world class procurement offering. Here is a breakdown of those 5 focus areas: 1. Is there clear visiblity into the portolio's spend base? The ability to execute on cost reduction opportunities within a portfolio is only possible if there is clear visibility into the spend base for each portfolio company. It is critical that Accounts Payable (AP) data is collected and categorized on an annual basis for each company within a PE portfolio. Simple AP data analytics will go a long way in understanding where the strategic procurement opportunities exist both at the portfolio and cross-portfolio levels. Building out and maintaining a cross-portfolio spend cube is step one in realizing meaningful procurement value creation outcomes. 2. Is the strategy for low hanging fruit too simple? Interestingly, one of the biggest inhibitors of PE firms that keep them from being able to properly address procurement has been the prevalence of Group Purchasing Organizations (GPOs) in Private Equity. Don’t get us wrong, GPOs for common indirect spend categories such as small parcel, office supplies, and car rental are vital to a holistic procurement program and are part of our toolkit. However, it is all too common for PE firms to roll out GPO contracts to their portfolio companies, consider procurement to be “addressed,” and move on to the next priority, leaving millions of dollars on the table for their portfolio companies. GPOs work for portfolio companies with small to medium size spend in select categories, but once spend in a category exceeds a certain spend level, “off-the-shelf” GPO pricing is rarely the most competitive. 3. Does a strategy exist for portfolio company specific engagements to garner a higher return? The most meaningful procurement impact and EBIT relief will come from strategic portfolio company specific procurement optimization projects. These engagements will use the AP data analytics mentioned above to identify multiple spend categories at a portfolio company that can be addressed through strategic sourcing. Some common reasons why significant strategic procurement opportunities exist at mid-market PE backed companies are a lack of in-house category expertise, fragmented purchasing, a lack of unit level data, and a lack of procurement resources. The ability to identify and execute on these cost reduction opportunities at the portfolio company level in a rapid fashion (3-6 months) creates excitement amongst both the executive teams at portcos and PEdeal teams. 4. Does the program enable and develop procurement leaders across the portfolio? Introducing procurement knowledge and expertise to specific portfolio company is certainly useful, but being able to effectively share and transfer knowledge across the portfolio and educate multiple companies on procurement best practices is an additional layer of value that a best-in-class PE procurement program can provide. Providing the portfolio with access to CFO forums, procurement panel discussions, and SME presentations will help to maximize the utilization of procurement best practices. 5. Can spend be leveraged across the portfolio in certain categories? When reviewing a portfolio wide spend cube comprised of AP spend data from each portfolio company, common vendors and spend categories should emerge. This will be even more apparent if the PE firm’s investment focus is sector driven. There are a number of spend categories where there is a significant opportunity to leverage spend cross portfolio and use the portfolio’s collective purchasing power to negotiate favorable discount and rebate structures with best-in-class vendors. Treya’s MPP program is a holistic five-pronged program that creates a strong procurement foundation for our private equity clients by addressing each of the above areas. Our approach was developed through years of experience working alongside mid-market PE deal and ops teams and implements a program that can rapidly create meaningful EBIT impact while withstanding the headwinds of a fluid and constantly changing PE environment. By Chris TasiopoulosChris Tasiopoulos is a Business Development Manager with Treya Partners. Based in Boston, MA, Chris supports Treya Partner's private equity clients in several key markets.

0 Comments

Leave a Reply. |

Categories

All

|