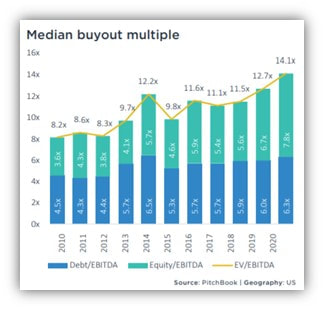

The coronavirus pandemic has not slowed private equity firms from putting their capital to work. Deal activity may have been down from March to April 2020, but deal volume was able to rebound by the fourth quarter of 2020, with deal counts and deal values reaching 10-year quarter highs. Deal multiples have also recovered from early 2020, with the median buy out multiple now at 14.1 (see chart 1). Historically, large, economically disruptive events like the "Great Recession" (2008 – 2010) have had a noticeable impact on private equity portfolio companies' holding periods. Specifically, investments made just before the recession, at peak valuations, were held longer. Chart 2 illustrates the increase in holding periods, peaking at 5.6 years in 2014. These acquisitions required longer holding periods to realize respectable returns. Consequently, median holding periods elongated. From 2014 – 2018, median holding periods for PE portfolio company exits showed a slight-but-steady downward trend, then leveled off just below five years. The coronavirus' extreme economic impact is expected to increase the median holding period as private equity firms delay exits, just like they did in the last recession.  Almost without exception, PE firms will be looking to carefully manage their portfolios and create value during these extended hold periods in the wake of the pandemic (Jones, 2020). Procurement represents an often-untapped opportunity for value creation for many PE firms and their portfolio companies. Many PE firms are behind the curve on managing procurement. Given that operational value creation can account for up to 50% of some funds' internal rates of return (IRR), procurement should be a strategic consideration at the fund level. Optimizing procurement can help PE firms and their operating companies reap the rewards and reduce portfolio risk. Treya Partners helps our private equity clients leverage advanced procurement capabilities portfolio-wide; this represents a competitive differentiator. Whether your objectives are EBITDA improvements, budgetary cost savings, organizational or business process improvements, or procurement capability development, we provide the right mix of services, best practices, and expertise to deliver results. Our procurement programs are a significant value creation lever for our clients in what remains a highly volatile climate. By Steven DelCarlino, Manager, Treya Partners About the Author Steven DelCarlino leads client engagements and project teams for Treya Partner’s private equity clients and their portfolio companies. With over 15 years of experience working directly with corporations, international businesses, and private equity portfolio companies on strategic sourcing projects, Steven brings a diverse knowledge of spend categories and project management experience. Steven and his team provide a rigorous fact-driven analysis that accounts for the total cost of ownership, service needs, and long-standing supplier relationships for each engagement. Steven has managed sourcing projects in the logistics, packaging, raw materials, finished goods, facilities services, MRO, IT, and wireless sectors, among others. Before joining Treya Partners, Steven was a Manager with GEP Worldwide, a global provider of strategy, software, and managed services to procurement and supply chain organizations. Steven also led the procurement and supply chain offering at CMF Associates (now CBIZ Private Equity Advisory), a financial and operational solutions provider to private equity firms and their portfolio companies. Steven holds a Bachelor of Business Administration from Temple University and is an MBA candidate at the Kettering University School of Management; Steven also has a Supply Chain Management Certification from Villanova University. References: Jones, A. (2020, May 07). Private equity portfolio company holding Periods – Updated. Retrieved February 25, 2021, from https://blog.privateequityinfo.com/index.php/2020/05/07/private-equity-portfolio-company-holding-periods-updated-4/ US PE Breakdown. (2021, January 11). Retrieved February 25, 2021, from https://files.pitchbook.com/website/files/pdf/2020_Annual_US_PE_Breakdown.pdf

0 Comments

Leave a Reply. |

Categories

All

|