The Process and Life Cycle of Engagements as an Integrated Partner in the Value Creation Plan11/27/2023 Treya's goal is to be an extension of the Private Equity operating partner team and an integrated partner in the value creation plan and process. Chris Tasiopoulos describes the process that takes Treya Partners from being a service provider option to being a true partner with the operating team and their portfolio companies.

0 Comments

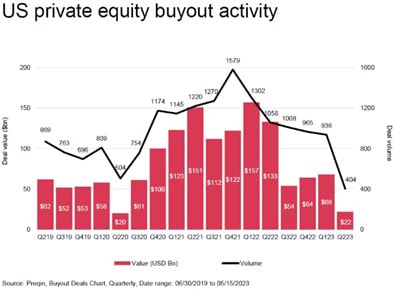

Many Private Equity Operating Teams and Portfolio Management Teams are modifying their approach to procurement value creation to deliver returns for their investors. With the reduction is deal volume, rise in interest rates, and softening of demand in many sectors, teams are turning to procurement more and more as a lever to drive value. The Main Challenges Private Equity Operating Teams are Facing in the Current Market Conditions11/27/2023 The market conditions for Private Equity in 2023 are significantly different than 2022. The changes are bringing a new set of challenges for the operating partners and portfolio management teams. The macro condition changes in 2023 are driving changes for the Private Equity Operating Partners and bringing significant opportunity to deliver additional value, dedicate additional time and energy to supporting portfolio company CEO and CFO's, and overall showcase the return on investment that the portfolio management teams can provide. The deal activity and headwinds from the first half of 2023 are a major turn from the same period one year ago. Chris Tasiopoulos, Vice President of Business Development with Treya Partners, expands on the key take aways in 2023.  1. Conduct a Legal Spend Assessment An assessment of your organization's historical usage of Outside Counsel is a valuable process to better understand the amount of work you allocate to certain firms, what matter types are business critical, and the average hourly billing rates for the lawyers, among others. This exercise allows visibility to spend patterns and where certain opportunities such as benchmarking hourly rates, implementing Alternative Fee Arrangements (e.g., fixed matter prices, blended rates), leveraging alternative legal service providers for less complex work, and consolidating the number of firms used. 2. Implement a Preferred Panel Program Best-in-class legal operations will include a list of their go-to preferred firms utilized for specific areas of work. Depending on the size of the legal function, it can be a concise list of firms that you will have agreements in place with and to be used frequently. This can be a robust process conducted with an extensive RF(x) where firms will put their best foot forward in terms of competitive pricing, offerings such as annual rebate programs, established Relationship Partners, and Quarterly Business Reviews (QBRs). 3. Adopt Legal Technologies Installing legal technologies in your organization can improve the efficiency and productivity of your operations. The marketplace for these tools is growing rapidly as businesses realize the opportunity to automate routine tasks such as document management, e-discovery needs, and contract analysis, while also being affordable to implement and maintain. Primary tools like a matter management system provide the tracking of matters and their results. These tools provide access to data analytics that assist in decision-making efforts and visibility into matter details. The relative nature of legal can be highly confidential as well and technology improves the necessary security for sensitive information. 4. Employ a Matter Bidding Program A matter bidding program will ensure the most competitive pricing available for when matters arise and help with control costs as matters run much longer than expected and can be key to get in front of from the onset. A key benefit of this program is the establishment of all agreed upon terms such as rate cards and caps on the overall cost of a matter or specific lawyer that works at a higher hourly rate than others. 5. Run an Internal Workload Survey It can be a healthy exercise to gather feedback from your internal lawyers on what types of activities they do on a weekly basis and other general thoughts that they may have to improve the department. Based on the results from the survey, leadership can take a more guided approach to how work is internally allocated and where innovations may be applicable. By Zach CorningZach Corning is a Senior Consultant at Treya Partners. Zach has over 8 years of management consulting and operational business analytics experience, with a focus on procurement and strategic sourcing. He uses a methodical approach to create cost reductions and operational improvement. He has a breadth of experience across many industries and spend categories and is focused on driving solutions and client outcomes that achieve measurable results. In today's competitive business landscape, marketing is essential for growth and success. However, with the ever-increasing pressure to deliver results and the need to optimize budgets, marketing procurement has become a critical aspect of any organization's strategy. By implementing effective marketing procurement best practices, companies can decrease costs and improve their return on investment (ROI). In this blog post, we'll explore three key strategies to achieve these goals.

Marketing procurement best practices play a pivotal role in reducing costs and enhancing ROI. By consolidating vendors, strategically sourcing suppliers, establishing performance metrics, promoting transparency, and embracing technology, organizations can optimize their marketing spend and drive better results. As marketing continues to evolve, a proactive approach to procurement will be essential for staying competitive and achieving sustainable growth. If you are interested in learning more about improving your marketing procurement practices, the Treya Partners team is here to help! https://www.treyapartners.com/contact-us.html About the AuthorThomas Walsh is an Analyst with Treya Partners focused on procurement and supply chain improvement for private equity backed clients. During his career, Thomas has provided procurement and strategic sourcing services across multiple industries including Pharmaceuticals, Medical Devices, CPG, Tech, and Manufacturing. Thomas has addressed numerous spend categories with a area of expertise in marketing procurement. Project results include: We are pleased to announce the successful renewal of our Private Equity Small Parcel Group Purchasing Organization contract with UPS, a global leader in logistics and package delivery. The 5-year renewal solidifies the successful partnership and underscores Treya Partner’s commitment to delivering exceptional supply chain services to Private Equity and their portfolio companies. Under the renewal agreement, Treya and UPS have extended the Private Equity program through 2028.

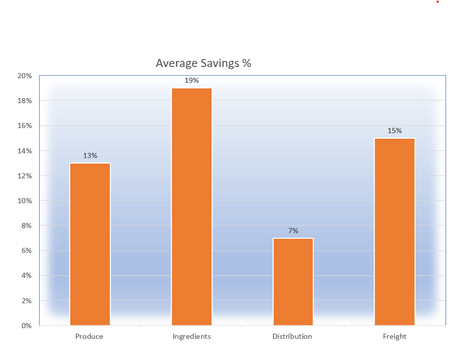

Treya Partners has been working closely with UPS for three years, leveraging their expertise in supply chain management to optimize operational efficiency and enhance customer satisfaction within Private Equity. The successful 5-year renewal of this contract highlights the trust and confidence that Treya Partners places in UPS as a strategic partner. Under the renewed agreement, Treya Partners will continue to collaborate with UPS and the various UPS solution teams to streamline and enhance cross portfolio small parcel solutions for Private Equity and their portfolio companies. Treya Partners' innovative solutions and industry-leading technology will help Private Equity drive even greater value for their portfolio companies and Limited Partners (LP’s). Treya Partners' comprehensive suite of procurement and supply chain value creation services for Private Equity encompasses due diligence, post-close and pre-exit analytics, and optimization. The Treya team of experienced professionals work closely with UPS and our Private Equity clients to identify areas for improvement, implement innovative solutions, and adapt to evolving market dynamics. The contract renewal between Treya Partners and UPS represents a significant milestone for Treya Partners. It reinforces our vision of creating agile, efficient, and customer-centric solutions for private equity firms and portfolio companies that can adapt to the evolving demands of the global market.  Reducing costs for food ingredients and produce can be a strategic approach to improving profitability and efficiency in the food industry. Over the last six months, the team at Treya Partners has been able to generate significant cost reductions for our PE-backed clients in the food industry. The Treya team incorporates a holistic approach to cost reduction and value creation. Our process begins with a complimentary assessment of Account Payable data to frame the addressable categories and potential savings opportunities followed by collaborate working sessions with our client to further define the scope, approach, and timeframe to execute. From there, the Treya team conducts line-item purchase history data collection, contract reviews, market analysis and additional deep dives with category stakeholders. The delivery process for our Food Services client’s incorporated a combination of the following methods to achieve the highest level of savings while maintaining quality products and service levels.

Private Equity deal-flow has declined significantly in Q1 and Q2 of 2023. Economic uncertainty, driven by factors such as geopolitical events, and global market volatility, are making an already challenging deal-making environment even more difficult. Further, rising interest rates are making it tougher to secure appropriate debt financing to support deal values. There is also a valuation gap that still exists between sellers and PE buyers. In this challenging environment identifying untapped procurement opportunities can provide an additional source of value to getting a challenging deal over the finish line. To uncover these opportunities, we recommend that a systematic approach be utilized during due diligence to analyze the target company's procurement processes, supplier relationships, and cost structures:

By utilizing the approach above as part of their due diligence, PE firms can uncover margin improvement opportunities within the target company's procurement function. Detailed analyses can also be conducted to estimate the opportunity and potentially underwrite a portion of that in the deal investment thesis. |

Categories

All

|