|

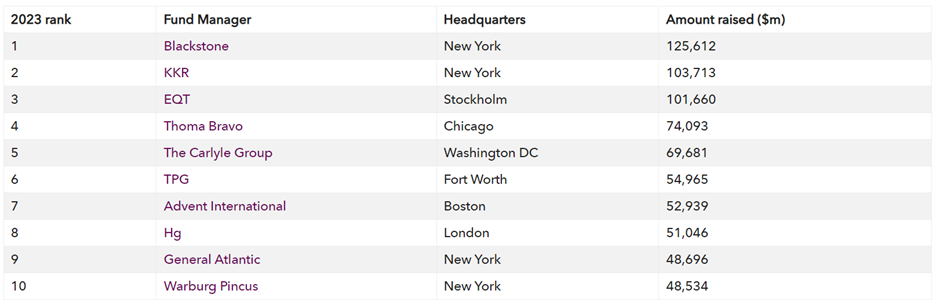

Private Equity International recently released their annual ranking of the industry’s largest capital raisers. The rankings “measure the fundraising totals of the biggest Private Equity firms over the past five years”. Despite economic factors and conditions that should hamper fundraising efforts, the big dogs continue to eat. The top 10 is populated by the usual suspects: Source: Private Equity International So what can we glean from this report? First, it is to be noted that despite LP allocations being reduced due to economic headwinds, there are three firms that have amassed more than $100B in capital raised. It’s no coincidence that these firms also have the deepest benches when it comes to resources around value creation in the private equity industry. But what about the vast majority of Private Equity firms globally that don’t have the seemingly bottomless barrel of resources at their disposal? They are going to have to figure out their value creation playbook and begin implementing it in a successful and expeditious fashion ahead of their next fundraising round or they open the door for this list to get even more top heavy in the years to come. Experience and differentiation are the two most important criteria for LPs when allocating and if the smaller funds are unable to leverage their size to move swiftly and nimbly towards executing value creation strategies at their portfolio companies, we’re going to see the larger scale firms further inflate their share of available capital year over year. We’re already seeing a refreshed focus on portfolio operations in the first half of 2023. At first glance, this can simply be attributed to slower deal flow and more PE focus turned inward towards their existing portfolio. But when you take a closer look, you’ll notice that press releases and broadcasting of these efforts and organizational changes to further drive them is aimed directly at LPs. At Treya, we’re excited to be working with more PE firms than ever as they work to bolster and amplify their value creation efforts. If these rankings are any indication, we can expect that momentum to grow in the back half of the year so mid and lower-mid market funds can stay in the game.

0 Comments

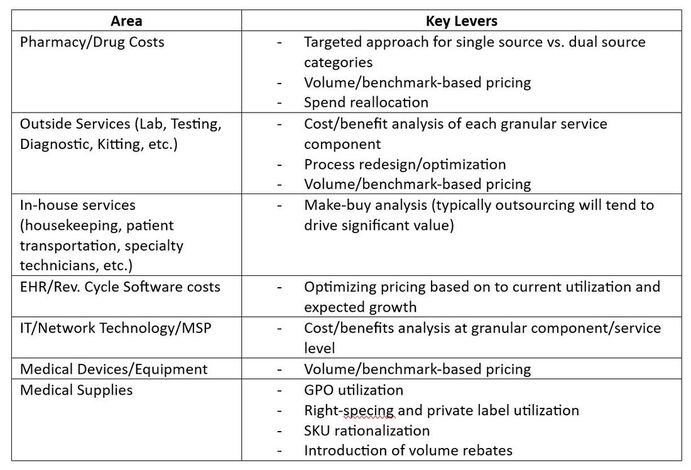

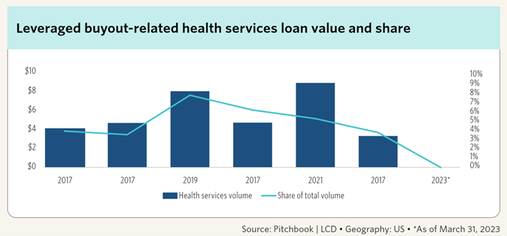

Macroeconomic Environment The current macroeconomic environment is proving to be challenging for Healthcare Services Private Equity. Deal volume (both platforms and add-ons) has seen a significant slowdown in 2023, reflecting the challenges in the current environment. Exits are attracting lower valuations and debt financing for new deals is also creating challenging headwinds. Rising Input Costs At the same time, the investments themselves are facing significant margin pressures from an increase in key input costs like labor, pharmaceuticals, and medical equipment and supplies. To compound margin pressures, reimbursements rates have not kept pace with rising costs. Additionally, demand for non-critical medical services is also softening. Finally, the current inflationary environment, with its tighter monetary policy is significantly impacting debt servicing requirements. Strategic Procurement ApproachWe, at Treya Partners, have worked with numerous PE backed medical services platforms (in various sub-sectors including eye-care, dermatology, acute care, respiratory and infusion therapy, skilled nursing, and correctional services), and based on these experiences believe that there is a meaningful opportunity for these companies to utilize a strategic procurement approach to drive down key input costs. While there is typically some procurement synergy capture as platforms grow through acquisitions, these efforts tend to be limited to basic contract/price “cherry-picking” for common spend areas. We recommend that companies consider utilizing the conceptual framework below (which we have successfully used with numerous healthcare platforms) to identify and tackle their rising input costs. We believe key elements of a successful cost-reduction effort should include upfront comprehensive data collection (spend-level, unit-level, and contracts), category prioritization, robust category strategy development, comprehensive identification of category specific savings levers, and utilization of benchmark-based negotiations. These efforts can be conducted in-house or with the help of a third party with experience in these spend areas.

As macroeconomic conditions and overall market conditions continue to impact supply and demand, we review the United States market for freight market including TL, LTL, Ocean, Rail, and Small Parcel. As a mid-market private equity backed company approaches its exit, one key factor that can significantly increase enterprise value is a well-executed and well-timed strategic sourcing/procurement project. When nearing the end of a PE hold, a strategic sourcing engagement can help reduce costs, improve efficiency, and enhance supply chain resilience, which can all positively impact enterprise value.

Here are a few ways in which a strategic sourcing/procurement project pre-exit can meaningfully increase enterprise value for a mid-market private equity backed company:

Ultimately, a well-executed strategic sourcing/procurement project pre-exit can significantly increase enterprise value for a mid-market portco. By focusing on cost savings, operational efficiencies, risk mitigation, supplier relationships, innovation, and data analytics, a company can demonstrate to potential buyers that it has a well-managed and financially stable supply chain that is poised for future growth. The past six months have been an interesting time for Private equity firms. A deal environment that was overflowing with exits and closes not long ago has come to a grinding slow down. Contributing factors such as interest rate increases, multiples coming back down to earth, and a pullback from LPs have all led to deal teams with more time on their hands and a renewed focus on current holdings. These current holdings are, in many instances, facing headwinds of their own as demand has slowed amid the economic downturn here in 2023. This had led GPs to spend more time focusing on the operational health of their portfolios and implementing additional workstreams to drive efficiencies. The more that can be done to generate EBITDA improvement outside of headcount reduction, the better. One way PE firms have combatted these headwinds is to deploy a firm like Treya into their portfolio companies to align with management and execute a strategic sourcing project. Improved commercial terms with vendors, risk mitigation, and internal capability development are the main outcomes of this type of work

In conclusion, strategic sourcing is an essential tool for private equity firms and portfolio companies to prioritize, especially during periods of economic uncertainty and slowing demand where we find ourselves today. By reducing costs, mitigating risk, creating value, and developing internal procurement capability, strategic sourcing can help private equity firms maximize their returns on investment and achieve long-term success. By Chris Tasiopoulos In a report published March 2nd, the debt rating agency Moody’s Investor Services has downgraded the ratings of Lasership, Inc., the corporate parent of regional parcel carrier LaserShip-OnTrac. According to Moody’s, the company has “very high financial leverage, week liquidity and moderate scale in the competitive e-commerce residential delivery market.” The Moody’s corporate rating was lowered to Caa1 from B3 and the probability of default rating to Caa1-PD from B3-PD.

Companies rated Caa are judged to be of poor standing and subject to very high credit risk. Moody’s numerical modifiers 1, 2 and 3 are generic rating classifications. The modifier 1 indicates “that the obligation ranks in the higher end of its generic rating category; the modifier 2 indicates a mid-range ranking; and the modifier 3 indicates a ranking in the lower end of that generic rating category.” The next rating level below Caa is Ca. Ca is defined as “… speculative and are likely in, or very near, default, with some prospect of recovery in the principal and interest.” What is behind the headwinds in the regional small parcel market that, in the very recent past, was executing successfully on organic and non-organic growth strategies?

For transportation and logistics team making carrier decisions, 2023 will be an interesting year. Coming out of Covid-19 and historical shipment volumes, the capacity issues are in the rearview mirror, but each carrier has their own challenges to overcome. FedEx’s pilot union is considering a strike authorization vote. Negotiations have been ongoing since May 2021 with reasonable progress reported through December of 2022. Since December, FedEx and the union have not been able to come to agreement on pilot compensation. Delta, Hawaiian and other airline executive teams have signed agreements with their pilots to improve compensation placing additional pressure on FedEx. UPS’ union contract with their drivers expires in July 2023 and we can expect the next several months to be full of intense negotiations. UPS appears to be committed to good faith negotiations. UPS recently published information regarding the negotiations. Click here to read more about the UPS / Teamsters Union negotiations. Sources:

Top tips to get ready for the holiday season. It's the most magical time of year. But also the most demanding. The enclosed slideshow shares several tips to prepare for peak and also includes the UPS year end holiday schedule. UPS is expecting the busiest day to be Wednesday December 1st following the surge of Black Friday and Cyber Monday online shopping.  Poor performance during holiday peak for e-commerce companies can impact revenue far beyond the holiday season, with the primary driver of customer experience being timely order fulfillment. Historically, November 28th to December 24th marked the peak season for shipping for small parcel carriers across the globe. A study on 2021 peak season emphasized the change in peak season - it now begins earlier and last longer, with 35% of consumers starting their holiday shopping earlier and 45% reporting they finished their shopping before December. It is estimated that approximately 3 billion packages are shipped across the carriers’ networks during this time period and the most crucial statistic during the peak season is on-time performance. In this article, we will dive deeper into what Private Equity firms and their e-commerce portfolio companies are doing to plan for this year’s peak season. We will cover common challenges and issues that e-commerce companies will encounter in the 2022 peak holiday season and how to layout a plan to reduce fulfillment challenges, thereby driving higher customer satisfaction and securing revenue both for today and the future. We will share thoughts on optimizing peak season small parcel shipping within Private Equity portfolio companies from industry experts to help ease the stress around peak season shipping. Challenges and Issues: E-commerce companies looking to out-perform their competitors must now manage a volatile supply chain, challenges with maintaining sufficient inventory, and the rising cost of shipments. As we approach the peak holiday season, the shipping experience will be more important to companies’ bottom lines and brand reputations than ever before. Research by Oracle found that 74% of senior executives believe that good customer experience directly impacts customer retention. According to Esteban Kolsky, 72% of customers will share a positive experience with 6 or more people. On the other hand, if a customer is not happy, 13% of them will share their experience with 15 or more people. The challenge here lies in the fact that, in most cases, customers don’t tell you they’re unhappy. In fact, only 1 in 26 unhappy customers actually complains. With increased competition and the knowledge that the majority of unhappy customers do not provide feedback, the need to win the customer experience battle is elevated during holiday peak for the e-commerce sector. In order to exceed customer expectations during the 2022 holiday season, e-commerce companies must address many challenges, with an emphasis on the customer experience once the package leaves their facility. Here are some common challenges and issues facing the e-commerce sector this holiday season:

If these types of challenges and issues are not proactively addressed, both the immediate and long term impact to revenue and brand can be catastrophic. The greatest impact of holiday peak shipping issues is a loss of revenue that extends beyond the holidays. A poor customer experience during the stressful holiday season results in orders being cancelled, loss of repeat customer orders, and damage to reputation and brand stemming from social media posts by dissatisfied customers. A Guide to Planning for Peak Season Small Parcel Shipping: Get Ahead Meeting consumer expectations for delivery is key to building customer loyalty, as 79% of consumers are more likely to make a second purchase from a merchant after a positive delivery experience. The first step, when it comes to peak season parcel shipping, is to get ahead. According to Steve Denton, CEO of Ware2Go, “The good news, as we head into peak, is that we’re in better shape then we were this time last year. The supply chain has loosened up a little bit.” Denton recommends shoring up your labor strategy by getting a handle on your demand forecasting and inventory planning as well as liquidating inventory that is not turning ahead of peak. We have asked our Private Equity customers what they are doing to prepare for peak season and assess weak points or potential issues within their current shipping environment: For us, 2021 Peak prep included establishing and deepening our parcel relationships. With our partners, we were able to service our customers more adequately with better parcel pricing from our existing carriers, as well as leverage new partners for analysis to establish new parcel agreements. With our full suite of partners, we were able to both deepen and widen our parcel solutions for customers during the 2021 peak. (Jeremy Evans, Boutique Brands) As companies move into the prepping stage for peak season shipping, it’s important to continually monitor processes and systems internally to ensure efficiencies from when an order is placed on the website all the way through delivery. One way to evaluate your current situation is to assess if your current carrier is fully meeting your business needs – if not, onboarding a new carrier is a great way to put processes and systems in place with a clean slate. Taking stock and evaluating current performance leading up to peak season will help identify vulnerabilities and potential challenges with higher volumes. Capitalize on Available Resources Though it may seem there are no additional resources for your particular company, there are subject matter experts, software, carriers, and third party providers to take advantage of as you develop the roadmap for a more successful small parcel program. Some things to consider when looking for additional resources when it comes to small parcel shipping are:

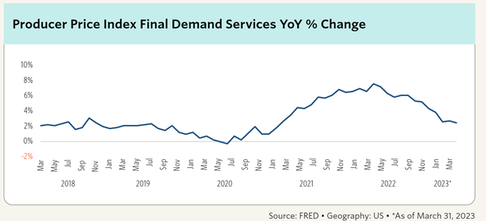

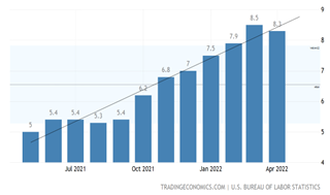

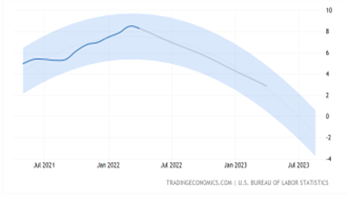

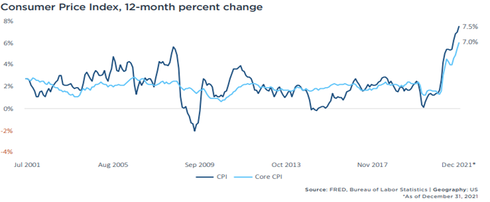

There are a variety of resources available to you to make sure you are optimizing your small parcel shipments and creating a solid foundation from a systems and process standpoint. Have a Plan! As we close in on peak season parcel shipping, having a plan can be the best way to ease concerns for your customers and internal workforce. One of the most critical ways to set expectations with your customers is to collaborate with your internal or external marketing team to advertise your delivery commitments and any potential promotions if customers were to buy from your business. This is one easy way to let customers know that you have a plan in place and guarantees that you can meet their needs when they order during this year’s peak season. There is also planning around facilities or warehouses that needs to take place. A recent study reported that 57% of consumers surveyed made a purchase last year from a retailer they had never done business with before. 37% of those shoppers did so because their first-choice retailer was out of stock. Does your facility have enough space for a potential increase in product warehousing needs? Is your carrier aware of the increased need for drivers for pickups or drop-offs? If there is an issue with pickup and drop off times, would adding an additional carrier help with the issues and needs of the facility? These are some of the questions that may need to be answered to ease some of the tension around the facility or warehouse and the carrier as we inch closer to the holiday peak season. Unforeseen circumstances are also in the mix when planning for peak season. Are you in a climate that experiences heavy snow in the fall/winter months? What if a facility needs to close for power outages or maintenance issues? Asking “what if?” questions around all your parcel-related needs can help with finding solutions and having a backup plan if issues arise. Chief Supply Chain Officer at Ware2Go, Chris Domby, offers the following advice for risk mitigation : "When warehouse vacancy rates are low, it's very important to distribute your inventory across multiple warehouses, giving you a smaller footprint in expensive coastal markets. If you're looking for an alternative to Southern California, moving just a little further North into Central or Northern California, you're likely to find more available space. If you want to avoid the West Coast all together, the port of Houston is an attractive alternative, and container volume is on the rise there. Texas has a large population, and its central location reduces long zone shipping across the country. On the East Coast, there is higher capacity and excellent ground shipping coverage in the Tennessee, Virginia, and Atlanta markets." (Chris Domby, Ware2Go) Planning for both increased demand and unforeseen circumstances is critical. Consider having multiple warehouses available to ship from or ship to for returns, or evaluate ramping up productivity within a certain warehouse where demand is going to be amplified. It is crucial for companies to explore these types of options before we enter the peak season shipping months. Purchasing, Delivery Execution & Customer Service: The last mile is quickly becoming the most important touchpoint in the customer experience and is often the area the merchant has the least amount of control. Overall, the shipping experience is becoming a larger pain point for both the merchant and the online shopper. Data shows that the top reason a shopper will invest time to leave a negative review is if a package was damaged or never arrived. Among the top five reasons for leaving a bad review is that the shipment was delayed or took longer than expected. Through timely planning, carrier partner selection and execution, the last mile can be an important differentiator for merchants. When talking about the holiday peak season shipping, one aspect that is often overlooked is the importance of the return experience. Having a seamless and easy return process, along with a quality customer service experience, is valuable. From when a e-commerce customer adds a product to their cart, the experience from that point through delivery and a potential return is critical for customer retention and loyalty, and positive small parcel shipping experiences are a key part of the customer experience. The positive customer experience is critical for companies as they work to meet or exceed expectations. Alongside customer satisfaction with purchasing and delivery, the customer service and returns processes need to be strong in order to maximize customer satisfaction. Plan for returns the same way you are planning for delivery of your products, as this will also ease concerns for when peak season comes around. Treya Partners: We have been a leading provider of Procurement Improvement Services across the public and private sectors since 2006. Clients served include 15 state governments, multiple institutions of higher education, and over 60 private equity funds. We also hold the first and largest small parcel Group Purchasing Organization (GPO) with UPS to deliver savings for Private Equity and their portfolio companies through a PE volume leveraged program.  Annual inflation rate in the US slowed to 8.3% in April from a 41-year high of 8.5% in March, but less than market forecasts of 8.1%. Energy prices increased 30.3%, below 32% in March namely gasoline (43.6% vs 48%) while fuel oil increased more (80.5% vs 70.1%). On the other hand, food prices jumped 9.4%, the most since April 1981 and prices also rose faster for shelter (5.1% vs 5%) and new vehicles (13.2% vs 12.5%). On a monthly basis, consumer prices were up 0.3%, slightly more than expectations of 0.2% but below a 16-year high of 1.2% in March. The index for gasoline fell 6.1%, offsetting increases in the indexes for natural gas (3.1%) and electricity (0.7%). Despite the slowdown in April which suggests that inflation has probably peaked, the inflation is unlikely to fall to pre-pandemic levels any time soon and will remain above the Fed's 2% target for a long time as supply disruptions persist and energy and food prices remain elevated.  Inflation has been one of the important thoughts as PE firms invest in companies in an inflationary environment. Year over year, consumer prices have remained above 5% and since the last half of 2021 the price index has reached 7% and, in some markets, far past that. There is a light at the end of the tunnel as forecasts indicate that inflation has peaked and will trend downward over the next 12 months according to the U.S. Bureau of Labor Statistics. In a broader sense, the current U.S. economy has been struggling from global supply chain disruptions due to the pandemic and other worldwide struggles resulting in labor shortages as well as supply shortages in many in-demand materials. With this widespread supply chain issue in company’s minds, due diligence processes focused on risks including rising prices in labor, energy, and raw materials which is also top-of-mind for PE firms as these investors look to invest in companies with costs rising and margins diminishing within certain industries. Furthermore, there is the risk of decreasing valuation within Private Equity portfolio companies because of lower EBITDA due to the inflationary environment. Firms are encountering new challenges with investments/valuations and exits because of the decreasing EBITDA potential within the middle market. In a firm's current portfolio, holding periods could be longer than historical holds because of the lack of ROI upon exit leading to hopeful change in the economy which may come later than expected.  Within Private Equity, deal-making in inflationary environments vary by industry. Healthcare and the industrial sector have seen decreasing earnings in Q4 2021, between 4%-6% due to inflation and other pandemic-caused issues. Though the collective YoY revenue is a growth for both sectors mentioned, the decrease in earnings for Q4 2021 shows the rise in costs in labor and raw materials. With the decrease in earnings, companies have slowed production in order to keep costs down and be cognizant of the recovering economy. PE firms investing in middle-market companies are especially mindful of the high-growth investments where inflation may take away from the potential earnings and growth potential at this time where the economy is uncertain, and the price of goods are heightened. Private Equity firms manage the existing portfolio, invest in new portfolio companies, and exit existing portfolio companies. In these phases of portfolio management, there is a constant reminder to execute on the value creation plan and navigate economic changes where upon exit, there is the highest valuation possible. With the current inflationary environment, portfolio management has their challenges because the value creation plan is either put on hold or takes longer to execute in order to yield the highest return upon exit. Though firms have their challenges within the portfolio, each company has their own set of challenges as well. Portfolio companies that have customers that pay for services or products have the option to increase the costs of goods or services to their customers. Another option for these companies is to find ways to save on the cost of goods or suppliers to keep revenue high and costs low. With current and prospective investments within the middle-market, the importance of the due diligence processes heightens in order to combat some of the current pricing of goods within particular industries. During that process, current vendor contracts and vendor efficiency need to be made a priority in order to forecast and model future costs and create growth in earnings. Leveraging different value creation services and market research will bring potential growth to companies and sustain that growth throughout inflationary periods. By: Ryan Peterson, Treya Partners Business Development Manager

|

Categories

All

|