|

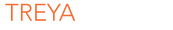

All steps of the Private Equity (PE) investment process are critical from early-stage due diligence to the final exit. After years of executing on the investment thesis including process improvements, product pricing optimization, cost reduction, talent management, add-on’s, tuck-in’s and excercising other value creation levers, a poorly planned or executed exit can make the difference between a great deal and a good deal. To unpack the value pre-exit procurement optimization can create, it is helpful to understand 2020 PE exit statistics: 2020 Private Equity Exit Activity Highlights

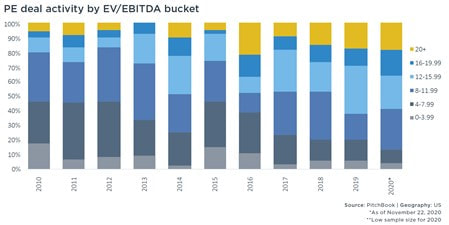

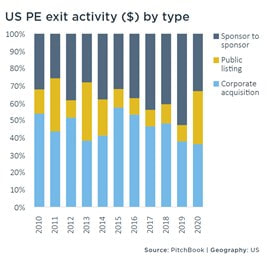

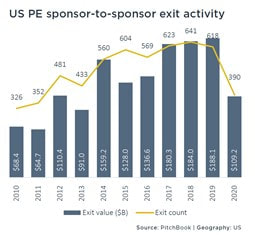

2020 PE Exit Details Total PE exit value increased from $357.0 billion to $378.3 billion despite the decrease in the number of exits  2021 forecasts indicate a high level of activity with some sources predicting 20% of buyouts will be priced above 20x EBITDA. The graph predicts a YOY increase in buyouts at 20x+. Price multiples in the public markets have carried into private markets. The S&P 500 now trades at a Cyclically Adjusted Price-to-Earnings (CAPE) ratio of 34.77, up from 34.52 last month and up from 30.73 one year ago. This is a change of 0.70% from last month and 13.3% from one year ago. In the private market, the median multiple for buyouts was 12.7x through Q3 2020 which is a record high. Although the average multiple is being driven up by larger technology buyouts that are well above the 12.7x EBITDA level, the majority of exits in 2020 were in the 12x to 20x+ range and the same is expected to be true in 2021  A noticeable trend is the decline of sponsor-to-sponsor exits from 2019 to 2020. 390 out of 952 exits (41%) were sponsor in 2020, while 618 of 1107 exits (56%) were sponsor-to-sponsor in 2019. Although overall exists in 2020 declined from 2019, the percentage decline in sponsor-to-sponsor exits was significant. Pre-Exit Procurement Value Creation The majority of owners struggle to create value past the initial one to three years of the holding period, during which the primary value levers are typically pulled included procurement process improvement, upgrade of talent to support strategic sourcing, and running competitive processes to drive out costs on indirect spend and CoGS. And as the multiples get higher, so does the bar for a successful exit that is taking advantage of all potential pre-exit value creation opportunities. One of the mostly widely underutilized pre-exit value creation levers is procurement. Using the 2020 average of 12.7x EBITDA as the valuation, a narrowly focused and strategically executed procurement improvement initative will typically delivery $10M to $25M in enterprise value for mid-market portfolio companies with increasingly higher returns as the addressable spend increases. At the beginning of the holding period, management is highly engaged and excited to kick-off the value creation process. The management team spearheads large transformation programs, systems upgrades and integrations, reductions in overhead expenses, and commercial improvements in areas such as pricing. In the years that follow, focus shifts to maintenance and M&A activity. The change often results in less focus on further sharpening of the pencil. Management becomes board. As management becomes distracted at the back end of the holding period, swift and targeted procurement value creation engagements can energize the team and produce meaningful impact. Results are dependent on several criteria: Criteria for a Successful Engagement #1 – Management has meaningful equity stake in the company: Equity owners quickly calculate the EBITDA impact of a cost reduction project to valuation and then to their bank accounts. The direct connection is much more immediate than early hold period projections. #2 - Proper Evaluation of Spend to Address: Spend addressed through procurement improvement activities must bring material improvement to EBITDA and create hard dollar savings to be included in Quality of Earnings (QofE) #3 – Adequate Time to Deliver & Document : At least 4 months is required to deliver and document savings during a targeted pre-exit procurement improvement initiative Steps to Maximize Procurement Value Pre-Exit Step 1: Perform an Accounts Payable spend analysis 18 months before the intended time of exit Step 2: Identify 3-5 spend categories or vendors with highest potential for cost reductions Step 3: Identify of sub-set of categories/vendors with lower cost reduction potential to leave on the table as potential value creation opportunities for the buyer Step 4: Determine combination of 3rd party and internal resources to execute on cost reduction efforts, which can include a mix of incumbent supplier negotiations, competitive bidding processes, and GPO utilization Step 5: Complete an ‘outside-in’ assessment of the savings opportunity for each category Step 6: Develop a category by category approach with timeline to execute Step 7: Execute Step 8: Document results for Quality of Earnings. Example of Treya Partners Enterprise Value Creation Results Treya Partner's Accelerate Program

Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya offers a broad range of value creation programs including Managed Portfolio Procurement (MPP), Procurement Transformation, and most recently, it’s pre-exit offering, Accelerate. Accelerate is a “SWAT team” approach to pre-exit procurement value creation designed to deliver maximum value in an abbreviated project timeframe for a seller while developing a procurement value creation roadmap for potential buyers. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements for both indirect (SG&A) and COGS spend categories in addition to implementing transformative procurement improvement projects. For further information, visit Treya Partners online at https://www.treyapartners.com.

0 Comments

Leave a Reply. |

Categories

All

|