|

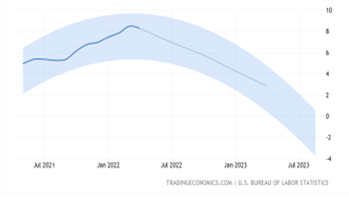

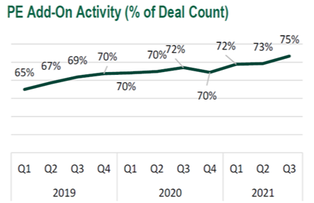

From a recent article written by the Wall Street Journal, firms have announced nearly $1 trillion ($944.4 billion) worth of deals in the U.S as of month ending September 2021 which include buyout deals as well as exits. This figure is 2.5 times the amount from the same time period in 2020. We will likely see new deal volume and exits increase through 2022 fueled by the current state of cash to deploy for equity investment and low interest rates on debt financing. When alluding to the increased buyout and exit activity in the Private Equity industry, we have also seen add-on’s increasing and as of September 30th, 2021, add-ons are at the highest level in history!  Add-ons accounted for 73.2% of US buyout activity in 2021. The total number of buyouts were 3,845 and of the total buyouts being completed in 2021, an impressive 2,814 were add-on’s leaving 1,031 non-add-on buyouts. At this pace, we can expect the final 2021 numbers to show a record high of buyout deals for the calendar year. We are seeing that add-on activity as a percentage is increasing partly due to Private Equity’s appetite in the past for platform investments that are driving add-on’s today, as well as the competitive environment forcing investors to put capital to work in areas like add-on’s that were not a traditional part of their investment strategy. In the end, it is hard to pinpoint exactly where the ambition comes from for these add-on deals. It is clear that add-ons as a percentage of the total deal volume is trending upward.  Further evidence that 2021 will be a record year is the following deal activity from Q3. The total deal count in Q3 was 2,227 creating the highest deal count in all of 2021. We are currently seeing a widespread distribution of deals in a variety of sectors including materials & resources, IT, healthcare, financial services, and energy. The reasoning behind most of the deals in Q3 being in these sectors could be because of the firm’s interest in more ESG related investments including strategic sourcing in materials, clean energy, and healthcare. With different trends entering the Private Equity space and encouragement from stakeholders to invest in strategic portfolio companies, the deal count is likely to rise in Q4 and in 2022.  With buyouts and add-on activity on the rise, firm’s internal resources to manage and execute on integrations and value creation plans will be stretched. In order to deliver on the investment thesis which may include capturing synergies from add-on’s, firms may need to onboard or expand their 3rd party service provider relationships to squeeze every bit of potential value out of these investments. The level activity combined with the current supply chain and labor constraints place an added burden on the teams and present an opportunity for the right partnerships to accomplish initiatives in areas such as sourcing of materials, transportation, and logistics solutions, along with the low hanging cost reduction opportunities in the portfolio to increase savings and efficiency across the board. With the add-on and buyout activity on the rise, it will be interesting to see where the final Q4 deal volume lands and what key indicators we can extract from 2021 to forecast trends for 2022. By: Ryan Peterson, Treya Partners Business Development Manager

0 Comments

Leave a Reply. |

Categories

All

|