Treya Partners purchases carbon credits on behalf of Public Goods to offset shipment carbon emissions

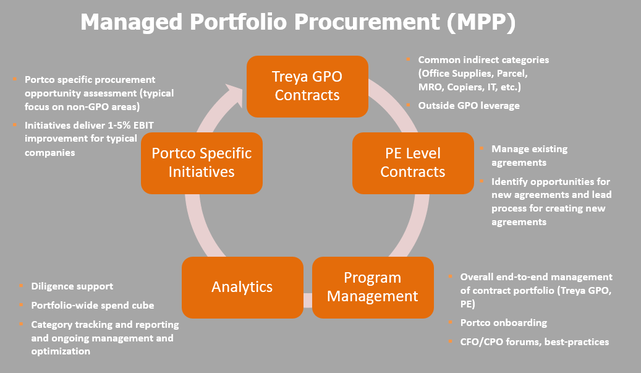

San Francisco, CA, November 8 2021 - Public Goods today announced that every Public Goods small parcel shipment is 100% carbon neutral* thanks to their participation in the Treya Partner’s UPS program. As a member of the Treya program, carbon credits have been purchased to offset the environmental footprint of shipments between November 2020 to April of 2021. Through this partnership, shipping emissions will continue to be offset going forward. Shaun Chambers, Treya’s Managing Director, states, “We are extremely proud to support Public Goods and their environmental initiatives.” Shaun added, “As a result of the Treya 100% carbon neutral shipping program, each shipment supports sustainability programs and environmental conservation projects.” Public Goods will reduce the environmental footprint of orders by investing in the emission reductions efforts of high-quality, verified carbon offset projects funded by Treya Partners. This commitment supports urban forestry, sustainable forest management, and rural cookstove programs that are designed to reduce or prevent greenhouse gases from entering the atmosphere. Public Goods will continue to purchase offsets to neutralize shipments through 2022, and the program comes at no cost to Public Goods customers. * Statement assumes that all company small parcel shipments are through the Treya Partners Small Parcel Program * About Public Goods Public Goods is your one stop shop for healthy, sustainable, everyday essentials you can trust. Our ever-growing selection of products spans personal care, household and cleaning essentials, pantry staples, pet care, and dinnerware — all with clean ingredients and considered packaging. Public Goods supplies peace of mind by planting a tree and carbon offsetting the shipping for every order. To learn more about Public Goods, please visit publicgoods.com. About Treya Partners Treya Partners® is a consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. For further information, visit Treya Partners online at www.treyapartners.com. Treya Partners to provide cross portfolio procurement value creation for Heartwood PartnersSan Francisco, CA, June 23, 2021 - Heartwood Partners has selected Treya Partners as the preferred provider for procurement value creation and cost reduction services. Heartwood Partners is a private equity firm with a focus on working with family and management-owned businesses. Heartwood seeks to fuel growth trajectories of companies by supporting and instilling confidence in their management teams through a combination of a strong balance sheet and many years of investment, marketing, operations, and human resources experience. Heartwood is partnering with Treya Partners to roll out Treya’s Managed Portfolio Procurement (MPP) program to drive cost reduction for their portfolio companies through strategic sourcing projects, monitoring of savings & compliance, managing volume leveraged vendor contracts, and moderating procurement best practices roundtables. Established in 2006, Treya Partners is one of North America’s leading procurement consulting firms for private equity. Treya Partners has worked with over 45 private equity firms on various procurement value creation initiatives including due diligence support, cross portfolio GPO & direct contract management, and pre-exit spend optimization. Treya’s MPP program was launched in 2019 in response to their private equity firm client’s requests for a holistic managed program. The MPP program is a 5-prong approach to procurement value creation - Spend Analytics/Spend Cube, GPO contract implementation, PE-level direct contract implementation, CFO/CPO roundtables, and Strategic sourcing. Shaun Chambers, Treya’s Managing Director, stated, “Heartwood has been a valued partner and client of Treya for many years. The Treya team is very excited to expand and formalize the partnership as a preferred service provider. The team at Heartwood Partners has established a tremendous reputation in the industry by establishing strong partnerships with management teams to help grow the business. We are elated to be providing additional expertise and force multiplier to existing efforts and launching new procurement and supply chain initiatives to increase profitability and drive EBITDA improvements.” Jason Phillips, Heartwood Partners Senior VP of Portfolio Operations, commented, “Treya Partners brings the experience and expertise to ensure we are maximizing value in key spend categories for our portfolio companies. Treya’s MPP program is an end-to-end solution that will provide additional value creation levers for our investments.” About Treya Partners Treya Partners is a consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owed companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and CoGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com. About Heartwood Partners Heartwood Partners is focused on partnering with family and management-owners. Their approach combines strategic execution with conservative capital structures to support long-term growth, including organic and acquisition-driven expansion into new products, services, and end markets. Please visit the Heartwood Partners website at www.heartwoodpartners.com to review their approach and investment portfolio.  Congratulations to Juan Velez on his promotion to Consultant. In Juan’s relatively short tenure with Treya Partners, he has had a tremendous impact on numerous client projects , both within higher education and private equity. Juan has successfully led numerous complex categories for our clients. In addition to consulting delivery work, Juan is also a key part of Treya’s data analytics and business intelligence practice. Juan is a perfect epitome of acute intelligence, client service, and team player attributes. Congratulations on the well-deserved promotion Juan!  Congratulations to Michael Yang on his promotion to Senior Consultant. During his tenure at Treya, Michael had worked across a variety of sectors and industries, including private equity, state government, higher education, technology, health care, and manufacturing. Michael has successfully led complex procurements and incumbent supplier negotiations across a diverse set of indirect and direct categories. He recently created $37M in contract length savings for a higher education client. Michael is a skilled category leader, is great at building consensus within complex stakeholder groups, and always places his client’s interest first. Michael is an exceptional team player who embodies the values that we cherish at Treya, and we appreciate all his contributions to the firm and our clients. Treya Partners to provide cross portfolio procurement value creationSan Francisco, CA, March 18, 2021 - Waud Capital has selected Treya Partners as the preferred service provider for procurement value creation. Waud Capital is a middle market private equity firm focused on partnering with exceptional management teams to build leading companies in their focus sectors of healthcare services and business and technology services. Waud is partnering with Treya Partners to implement Treya’s Managed Portfolio Procurement (MPP) program to drive cost reduction through strategic sourcing, monitoring of savings & compliance, managing volume leveraged vendor contracts, and moderating procurement best practices roundtables.

Established in 2006, Treya Partners is one of North America’s leading procurement consulting firms for private equity. Treya Partners has worked with over 45 private equity firms on various procurement value creation initiatives including due diligence support, cross portfolio GPO and direct contract management, and pre-exit spend optimization. Treya’s MPP program was launched in 2019 in response to their private equity firm client’s requests for a holistic managed program. MPP program is a 5-prong approach to procurement value creation - Spend Analytics/Spend Cube, GPO contract implementation, PE-level direct contract implementation, CFO/CPO roundtables, and strategic sourcing. Shaun Chambers, Treya’s Managing Director, stated, “Treya Partners is pleased to be selected as a Waud Capital preferred service provider. Waud Capital and their portfolio companies have established a strong name for themselves in the Private Equity industry. We are eager to apply additional resources to existing efforts within the Waud portfolio and to launching new initiatives to increase procurement efficiencies and drive EBITDA improvements.” Felipe Soares, Waud Capital Director – Business Intelligence & Strategy, commented, “Treya Partners brings an additional layer of experience and expertise to ensure we are maximizing value in all key spend categories for our portfolio companies. Treya’s MPP program is a complete offering that will provide additional, procurement driven, value creation levers to our investments.” About Treya Partners Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and COGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com. About Waud Capital Since its founding in 1993, Waud Capital has raised approximately $3.2 billion of capital commitments and has made more than 325 growth-oriented investments. Waud Capital partners with exceptional management teams to build leading companies in their focus sectors of healthcare services and business and technology services. Waud Capital’s disciplined and process-oriented approach has resulted in consistently superior risk-adjusted returns for their investors. Treya Partners to provide cross portfolio procurement value creation for HCI Equity Partners

San Francisco, CA, November 6, 2020 - HCI Equity Partners has selected Treya Partners as their preferred service provider for procurement value creation. HCI Equity Partners is a lower middle market private equity firm focused on partnering with family and founder owned manufacturing, service and distribution companies. HCI is partnering with Treya Partners to implement Treya’s Managed Portfolio Procurement (MPP) program to drive cost reduction through strategic sourcing, monitoring of savings & compliance, managing volume leveraged vendor contracts, and moderating procurement best practices roundtables. Established in 2006, Treya Partners is one of North America’s leading procurement consulting firms for private equity. Treya Partners has worked with over 45 private equity firms on various procurement value creation initiatives including due diligence support, cross portfolio GPO and direct contract management, and pre-exit spend optimization. Treya’s MPP program was launched in 2019 in response to their private equity firm client’s requests for a holistic managed program. MPP program is a 5-prong approach to procurement value creation - Spend Analytics/Spend Cube, GPO contract implementation, PE-level direct contract implementation, CFO/CPO roundtables, and strategic sourcing. Shaun Chambers, Treya’s Managing Director, stated, “Treya Partners is extremely excited to be selected as HCI Equity Partners preferred service provider. HCI and their portfolio companies have done excellent work in many spend categories. We look forward to putting additional resources into existing efforts and to launching initiatives in new categories to increase efficiencies and improve EBITDA.” Dave Venker, HCI Equity Vice President of Portfolio Operations, commented, “Treya Partners provides horsepower and expertise to ensure we are maximizing value in all key spend categories and has created a program that is sustainable and scalable to support current and future portfolio company requirements.” About Treya Partners Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owed companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and CoGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com. About HCI Equity Partners HCI Equity Partners is a lower middle market private equity firm focused on partnering with family and founder owned manufacturing, service and distribution companies. HCI builds solid partnerships with company owners and management teams to develop and execute growth strategies. For more information, visit HCI Equity Partners at www.hciequity.com. Treya Partners, a procurement value creation provider and spend management consulting firm for private equity, is pleased to announce that Steven DelCarlino has joined the firm as a Manager. Mr. DelCarlino is a career strategic sourcing consultant with over 15 years of experience driving EBITDA improvements through sustainable, transformative procurement initiatives across various industries including life sciences, industrial, sports & entertainment, aerospace, and higher education.  As a Manager at Treya Partners, Mr. DelCarlino will be leading client engagements and project teams for Treya’s private equity clients and their portfolio companies. Before joining Treya Partners, Mr. DelCarlino was a Manager with GEP Worldwide, a global provider of strategy, software, and managed services to procurement and supply chain organizations. Mr. DelCarlino holds a Bachelor of Business Administration from Temple University and is an MBA candidate at the Kettering University School of Management. Steven also has a Supply Chain Management Certification from Villanova University. Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for private equity. Treya Partners was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors, including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. For further information, visit Treya Partners online at: https://www.treyapartners.com. Treya Partners expands strategic supplier partnerships for Private Equity clientsSan Francisco, CA, January 15, 2020 - Treya Partners has entered into several new strategic partnerships to significantly expand its Group Purchasing Organization (GPO) category and supplier breadth and depth. Treya’s primary partnership is with the largest GPO in the United States covering both indirect spend categories and direct materials. The partnership will provide Treya and its clients with access to industry leading buying power and world class suppliers with an extensive portfolio of solutions. In addition, Treya Partners has extended its existing partnership with Office Depot for the healthcare industry and developed an improved discount structure for its UPS small parcel program.

These improvements to the Treya GPO program provide value to Private Equity firms and their portfolio companies beyond unit cost savings. The combined purchasing power Treya leverages leads to best-in-class service levels and stronger account representation from suppliers. Many of Treya’s supplier agreements also include member level rebates as well as program level volume rebates. Other benefits include:

For a full list of categories and suppliers, please contact us at: http://www.treyapartners.com/contact-us.html About Treya Partners Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owned companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and CoGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com. Treya Partners to provide cross portfolio procurement value creation for Private Equity clientSan Francisco, CA, December 15, 2019 - Treya Partners continues to expand their service offering for Private Equity clients with the release of the Managed Portfolio Procurement (MPP) program. MPP is a comprehensive, cross-portfolio approach to procurement value creation that is sustainable and flexible. The program drives EBITDA improvements regardless of addressable spend or portfolio company industry. The inspiration behind MPP was based on direct feedback from Treya’s private equity clients on their challenges with creating, managing and maintaining an effective procurement program. The main challenges were created by an ever-changing portfolio with exits and new acquisitions, limited internal operating resources and/or inconsistent resources, poor cross portfolio spend data, and determining the proper model to fund procurement work.  Treya’s response to these challenges is a 5-prong, fully managed approach to procurement value creation under a vendor funded model. Treya’s unique MPP program takes a holistic, managed service approach to procurement to produce sustainable best in class vendor contracts through managed Group Purchasing Organizations (GPO) and the development and management of Private Equity volume leveraged vendor agreements. MPP also includes overall program management of all contracts, portfolio company onboarding and the creation and oversight a CFO/CPO forum for the sharing of best practices & thought leadership. At the front and backend of MPP is Treya’s spend analytics. Treya has included full spend analytics as part of MPP for portfolio wide spend cube, category tracking and reporting, cost reduction identification, and due diligence support. The highlight of MPP for Private Equity clients is the majority of the program is vendor funded taking out the challenge of funding which historically has been a program non-starter. With the exception of the Portfolio Specific Initiatives, the entire program is fully funded by vendors. Treya’s objective is to come alongside their PE clients as a long-term partner and made the strategic decision to reinvestment the majority of vendor admin fees for various programs back into the Private Equity client. Treya is forecasting a strong year of onboarding new clients onto the MPP program and anticipates a 5-15% EBITDA improvement for the participating portfolio companies. Rahul Ahuja, a Treya Partner and Founder, stated, “MPP is unique in it’s combination of the multiple levers for procurement value creation as well as the removal of the barrier to entry. We have listened to our client’s challenges and now we are excited to present the Treya solution.” Ahuja added, “This is only the beginning of a program that we will continuously improve as it matures and as we gather feedback from our valued clients”. About Treya Partners Treya Partners is a management consulting firm specializing in procurement value creation, strategic sourcing, and spend management advisory services for Private Equity. Treya was established in 2006 by a seasoned group of supply management professionals and has served hundreds of PE-owed companies across a broad range of industry sectors including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Treya delivers meaningful EBITDA improvements from indirect (SG&A) and CoGS categories in addition to implementing transformative procurement projects. For further information, visit Treya Partners online at https://www.treyapartners.com or download overview: San Francisco, CA - Treya Partners, a leading procurement value creation firm for Private Equity, announced today an exclusive agreement with UPS (NYSE: UPS) to become UPS’ Group Purchasing Organization (GPO) partner serving Private Equity firms and their portfolio companies.

This strategic partnership combines Treya Partners’ procurement expertise and relationships in Private Equity with UPS’ world class transportation solutions. Under the Treya GPO, Private Equity firms will be able to offer their portfolio companies highly competitive, leveraged small parcel pricing with the global leader in logistics. Additional benefits will include comprehensive analytics and active category management by Treya, coupled with access to UPS’ broad range of solutions, including freight and advanced technology, to increase efficiency and profitability. “We are excited to partner with UPS,” said Rahul Ahuja, Co-Founder of Treya Partners. “With transportation playing an increasingly vital role for many of our clients, the opportunity to partner with UPS and a UPS Private Equity team that understands the objectives of a PE firm as well as the operational requirements of its portfolio companies will result in success for all parties involved,” added Rahul. “The Treya program enables our PE clients to realize benefits with UPS unavailable until now.” Learn more about the Treya and UPS partnership, please click on the link below to view the program overview. Treya Small Parcel Program Overview About Treya Partners Treya Partners (www.treyapartners.com) is a leading procurement value creation firm specializing in aiding Private Equity firms in unlocking procurement value within their portfolios. Founded in 2006, Treya's management team is comprised of a seasoned group of supply management professionals. Treya has served over fifty Private Equity firms and several hundred Private Equity portfolio companies across a broad range of industry sectors, including manufacturing, distribution, retail, financial services, life sciences, healthcare, and technology. Our approach and solutions have delivered impressive EBITDA improvements for our clients. |

AuthorWrite something about yourself. No need to be fancy, just an overview. |

AuthorWrite something about yourself. No need to be fancy, just an overview. |